Nội dung chính

- ADJUSTMENT OF THE CERTIFICATE OF INVESTMENT REGISTRATION IN VIETNAM

- In case of investing by contributing capital, buying shares or buying capital contribution.

- Procedures incurred after adjusting the Investment Certificate.

- Adjustment of the certificate of investment registration services at Asadona:

- The legal basis for adjusting investment objectives.

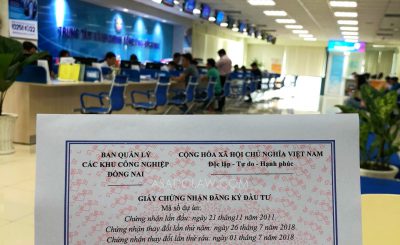

ADJUSTMENT OF THE CERTIFICATE OF INVESTMENT REGISTRATION IN VIETNAM

In case a foreign enterprise adjusts the information related to foreign investors who invest in the enterprise by contributing capital, buying shares or buying capital contributions, the procedures for adjustment of the Certificate of Investment Registration include the following steps:

- Step 1: Investors submit the dossier to the registry office where the head-office of the enterprise locates to perform the procedures for capital contribution, shares purchase or capital contributions purchase.

- Step 2: Investors submit the dossier to the business registry office to perform the procedures for record of investor’s information on the Certificate of Business Registration. If the enterprise has not separated the Certificate of Investment Registration and the Certificate of Business Registration, this requirement shall be performed at the same time. The number of the Certificate of Business Registration is also the tax registration number of the enterprise.

- Step 3: Performing the procedures for adjustment of the Certificate of Investment Registration to update the information of new investors and the investment project.

- Step 4: In case the enterprise supplement business lines or any other information on the Certificate of Business Registration, the procedures for adjustment of the Certificate of Business Registration must be performed at the business registry office as well.

- Step 5: Publishing the enterprise’s information on the National Business Registration Portal.

- Step 6: Re-issuing the seal sample of the enterprise which matches the information on the Certificate of Business Registration (for example: the new tax registration number) as recorded by domestic enterprises.

- Step 7: Publishing the seal sample of the enterprise.

- Step 8: Applying for a business registration license: applies only to businesses that add business lines that exercise the right to distribute goods.

Notice:

The enterprises that have not performed the procedures for splitting the enterprise registration certificate must separate the investment certificate into an investment registration certificate and enterprise registration certificate and re-issue a new seal, publish the seal sample as prescribed.

Procedures incurred after adjusting the Investment Certificate.

After adjusting the Certificate of Investment Registration, the enterprise shall follow some regulations mentioned below to avoid legal troubles:

- If the enterprise admitted new capital contributors, they must contribute capital to the capital account of the enterprise and capital contribution duration must be complied with the promised duration as recorded in the Certificate of Investment Registration.

If an investor fails to contribute capital as committed in the investment registration certificate, the enterprise must follow the procedure for capital contribution extension and be fined in accordance with law.

- The enterprise should pay attention to the procedures for report duties and report forms complied with the regulations on investment report duties of the enterprise (which are often regulated in Article 3 of the Certificate of Investment Registration).

- If the enterprise supplement new business lines which are subject to business conditions prescribed by the law, the enterprise should ensure to comply with these regulations.

Adjustment of the certificate of investment registration services at Asadona:

Asadona will consult clients about conditions, dossiers and the procedures for adjustment of the Certificate of Investment Registration, including:

- Drafting and preparing dossiers for clients with information provided by clients.

- Representing clients when performing the procedures for adjustment of the Certificate of Investment Registration at the state-authorized bodies.

- Supervising the handling process of the state-authorized bodies, explaining to the state-authorized bodies about any problems relevant to the dossier.

- Providing enterprise guidelines for legal procedures incurred after the adjustment.

- Consulting about issuance or adjustment of the sub-licenses after adjusting the Certificate of Investment Registration.

- Consulting and making changes to business registration certificates and adjusting investment certificates.

- Supporting clients to deal with any legal problems incurred during the business practices of the enterprise in Vietnam.

- Consulting about tax law, tax procedures and accounting for foreign enterprises.

The legal basis for adjusting investment objectives.

These procedures are implemented in accordance with the Law on Investment 2014, effective from 01/07/2015. Decree 118/2015 (providing detailed guides on the Investment Law), Circular 16/2015 / TT-BKHDT and Official Letter 4326 / BKHDT-DTNN (providing guidelines on procedures and forms for implementing investment activities under the 2014 Investment Law). Therefore, investors who follow procedures for adjusting Investment Certificate with the investment registration agency should refer.